Proven success across industries

Case Studies

Each of our case studies showcases our comprehensive approach to tackling complex challenges. Whether revitalizing outdated systems or launching groundbreaking solutions, our work speaks to our versatility and expertise.

Transforming the operations of a global leader in hot water heaters.

The team at Rheem knew a modern IoT platform could solve many of its business challenges. Over our 5+ year partnership, we built a suite of web and mobile applications on top of a fault tolerant, efficient platform.

Increase in Sales

Cost Savings for Homeowners

Hosting Cost Reduction

Changing how a premier QSR serves their customers.

A beloved, brand-forward QSR wanted to reach new heights for customer experience. We worked alongside them to provide never-before-seen customer service in their industry by adopting new technology.

Value Generated

Increase in Online Orders

Generated per Week

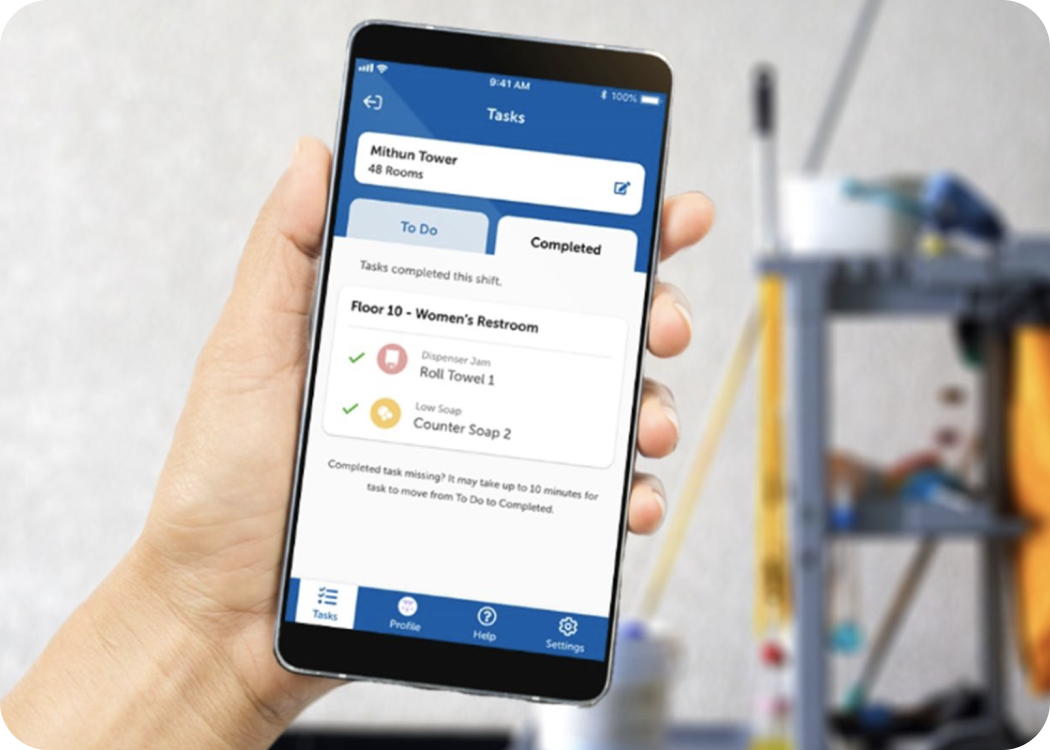

Building trust and providing cutting-edge insights and inventory tracking.

Imagine managing a large facility, like a huge office building. Now imagine the monumental task of proactively ordering and stocking products for your washrooms to make sure your guests never have to skip a hand wash.

Drop in Consumer Washroom Complaints

Reduction in Supply Waste

Decrease in Manual Dispenser Check-ins

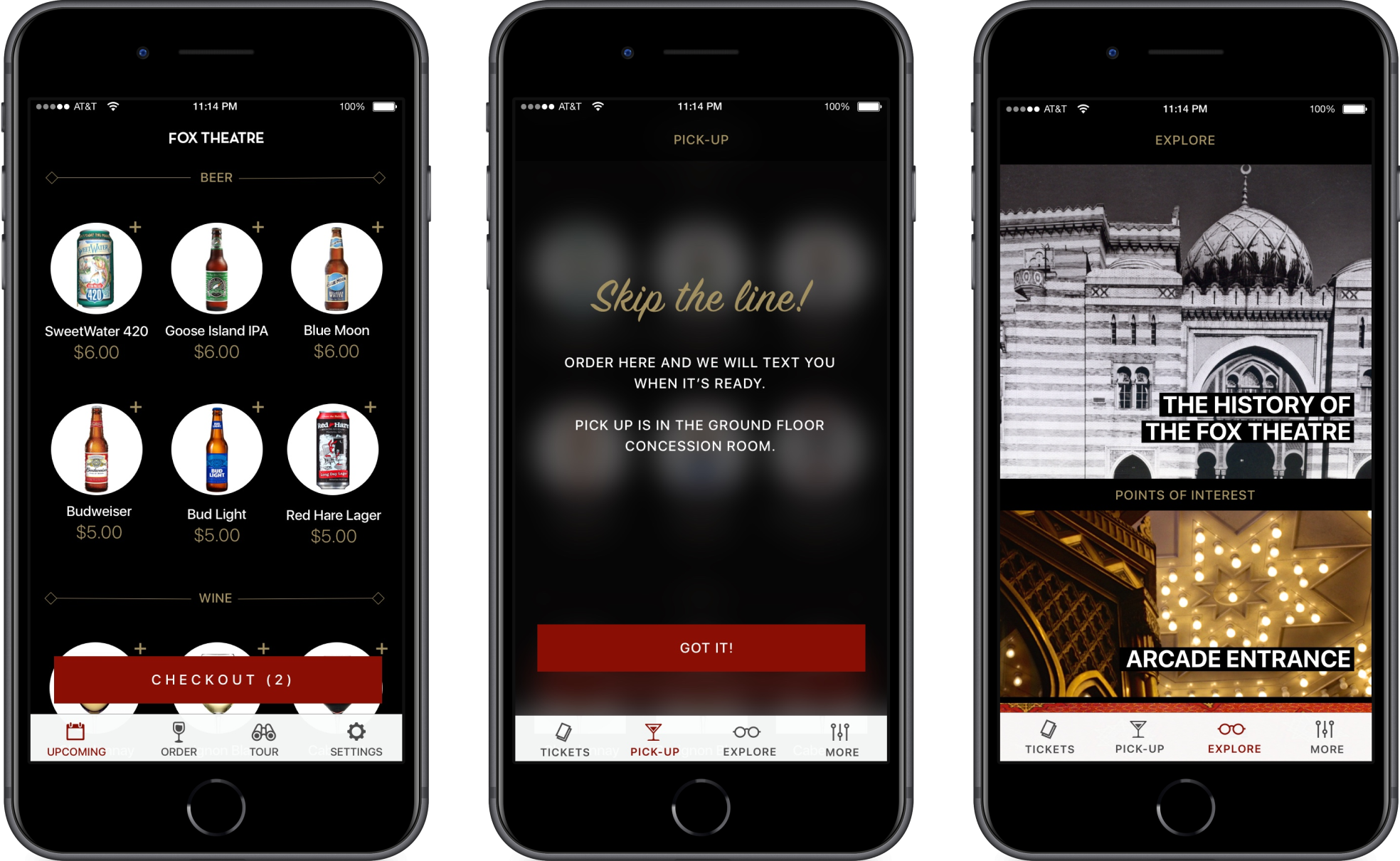

Enhancing the in-person experience at one of Atlanta's most iconic venues.

When a centerpiece of the Atlanta arts community noticed concession lines were having an impact on customer experience, we hatched a plan to make sure visitors could enjoy their favorite beverage and their favorite song.

Increase in Revenue

Favorite Songs Missed

Memorable Evenings

we're ready to meet you

Book a consultation.

We're always looking for our next opportunity to help a partner expand and transform their digital operations. You can take the first step today by clicking below to book a consultation.